Over the last 6 years we saw rates on mortgages fall to a level not seen before. In 2007 the average rate for a 30 year fixed rate mortgage was 6.25%. In the Spring of 2013 that rate had fallen to an average of around 3.5%. Let’s take a look at what that payment difference was in dollars on a $160,000 mortgage (all examples below are calculated based upon principal and interest payments only; tax and insurance escrows are not included):

Rate Monthly Payment Payment Difference % Change in Dollars

6.25% $ 985.15

3.50% $ 718.47 $ 266.68 - 27 %

The difference is $ 266.68, or 27 %. That is a significant savings on a monthly basis and over the life of a mortgage. But there is another “hidden” benefit to lower rates that is not always understood by consumers. That is, at a lower rate a homebuyer’s affordability increases...sometimes dramatically. Stated differently, the purchasing power of a homebuyer increases when rates decline. To use the example above, suppose the people who paid $ 985 a month in 2007 when rates were 6.25% were looking to buy a house in early 2013. How much mortgage could they buy for $ 985 a month with rates at 3.50% ? The answer was $ 219,387, an increase of $59,387 in home value or 37 % in dollars !!

Rate Monthly Payment Mortgage Amount Change in Affordability

6.25% $ 985.15 $ 160,000

3.50% $ 985.15 $ 219,387 + 37 %

This historic drop in rates benefitted homebuyers because they could buy a lot more house for the same monthly payment, and the affordability increase was unprecedented. In fact, I have been a mortgage banker for 27 years and I have never seen this kind of an increase in affordability. This increase in a buyer’s purchasing power, coupled with home prices which have gone back to 2004 levels, are the biggest reasons to buy a home today. (Source:Bloomberg)

Since the Spring of 2013, rates drifted up, due to a surging stock market and the belief that the economy was going to need less intervention by the Federal Reserve in the form of mortgage bond purchases. The expectation was that the Fed would begin tapering off the amount of mortgage bonds they would buy this year. The markets felt this would be announced in September. Due to this idea , and some other factors, rates began rising in June 2013 so that by the middle of September the average rate for a 30 year fixed mortgage was around 4.49%. (source: Freddiemac.com)

This rise in rates ate into the affordability increase so that the same buyer paying $ 985 a month could only buy $ 186,155 with that payment. As the chart below shows, the sudden rise in rates reduced the purchasing power for buyers by 15.2% which left many home shoppers wondering “What happened ?” when they started looking for a house.

Interest Rate Monthly Payment Mortgage Amount Change in Affordability

3.50% $ 985.15 $ 219,387

4.875% $ 985.15 $ 186,155 - 15.2%

Likewise, this sudden jump in rates also led to a large reduction in the number of homeowners looking to refinance.

So, as we have seen, the mortgage market has experienced two swings in affordability in a relatively short period, one dramatically up, making housing more affordable for all, and the other unexpectedly down, reducing that affordability for purchasers and refinancers. But fear not, for we have seen a strong rally in interest rates since September, so that on October 30, 2013, the interest rate on a 30 year fixed mortgage has dropped back down to a national average of 4.125%. (source: USA Today)

This drop in rates will generate a renewed opportunity for consumers seeking a mortgage because the increase in affordability will again lead to greater purchasing power. Again, using our borrower who can make a $ 985 monthly payment , the amount of mortgage obtainable for that payment at 4.125% is

$ 203,270, an increase of 9.2 % in just about 6 weeks time ! Amazing !

Interest Rate Monthly Payment Mortgage Amount Change in Affordability

4.875% $ 985.15 $ 186,155

4.125% $ 985.15 $ 203,270 + 9.2%

Finally, to align this with the historical perspective, we are now at a 27% increase in affordability for mortgages, down only 10% from the historic level of affordability we saw in the Spring.

If there was ever the belief that life or fortune or the fates sometime gives you a second chance, this seems be one of those times. Don’t miss this opportunity. If you did not refinance previously do it now ! If you are thinking about buying a house this second chance is the one you’ve been waiting for.

Need help? Got questions ? Call me… 401-743-4364

Written by Bob Ruth of JP Morgan Chase and edited by Tim Bray

ANSWER:

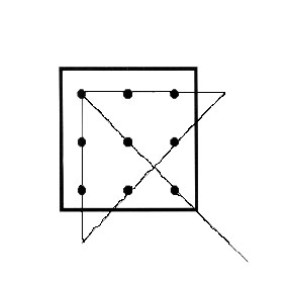

In order to solve this puzzle, you MUST let your pencil draw outside of the box! The directions never said you had to stay inside the black box!

Often, in our lives and in our world, we look at situations and see only one solution -- the rules are already in place and there do not seem to be any other alternatives. We drive ourselves crazy drawing the same lines -- doing the same thing -- over and over again, even though we know it just doesn't work!

Posted by Tim Bray on

Leave A Comment