Advantages and disadvantages of residential real estate.

Posted by Tim Bray on

Residential real estate refers to the purchase, ownership, and use of a home or apartment for personal living purposes. This type of real estate can provide several financial advantages and some potential disadvantages.

One of the main advantages of investing in residential real estate is the potential for long-term capital appreciation. Over time, the value of a well-maintained property can increase, providing a solid return on investment. Additionally, residential properties can generate income through rental payments, allowing investors to earn passive income.

Another advantage of residential real estate is the potential for tax benefits. Mortgage interest and property taxes are often tax-deductible, which can help reduce the overall cost of…

565 Views, 0 Comments

.png)

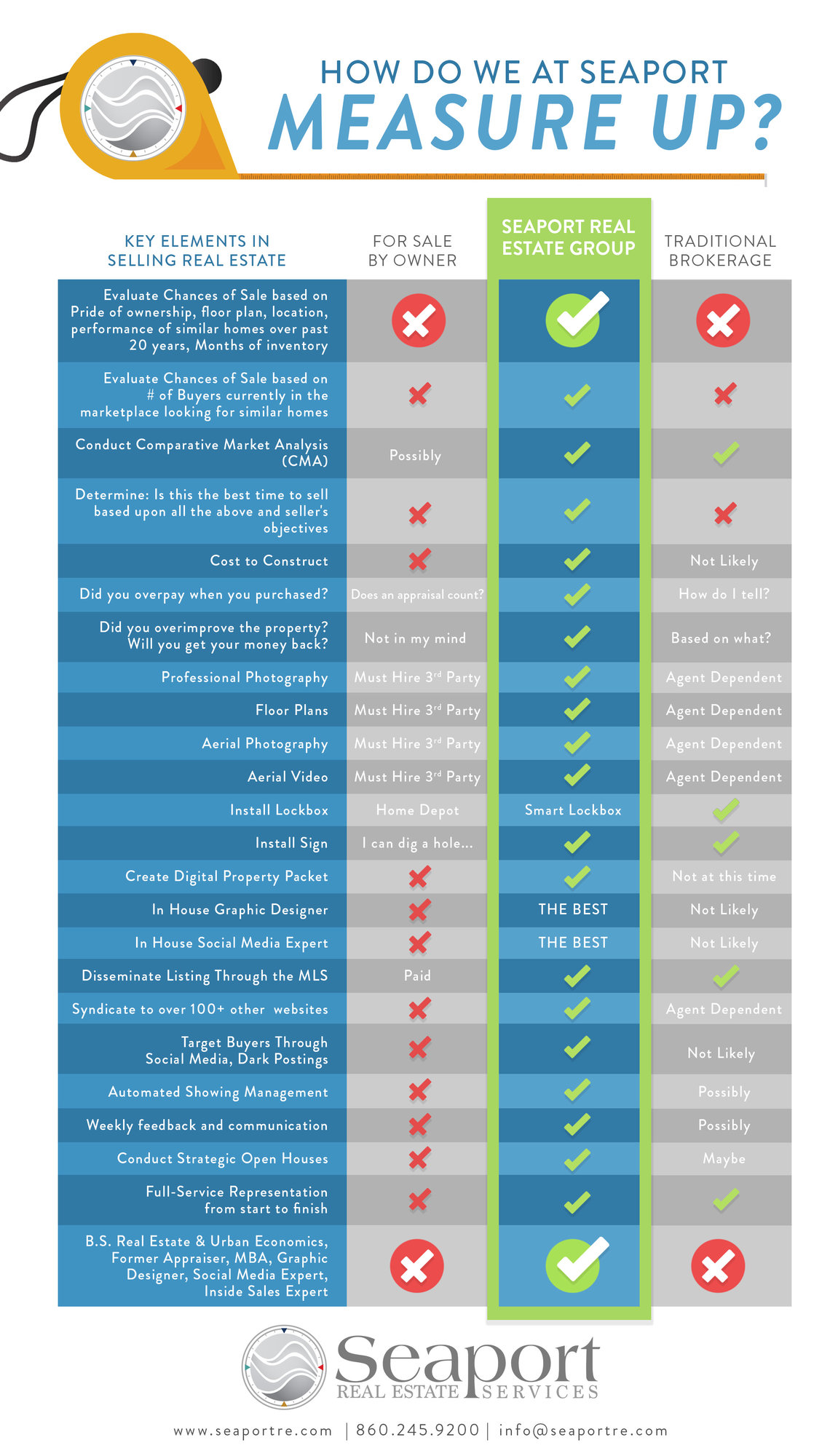

We think it's pretty clear. Contact Seaport today.

We think it's pretty clear. Contact Seaport today.