Looking to accelerate the depreciation schedule of your commercial building? There's a tax strategy that can do just that - cost segregation. It's like going through your closet and separating the designer pieces for a unique, more rapid depreciation treatment.

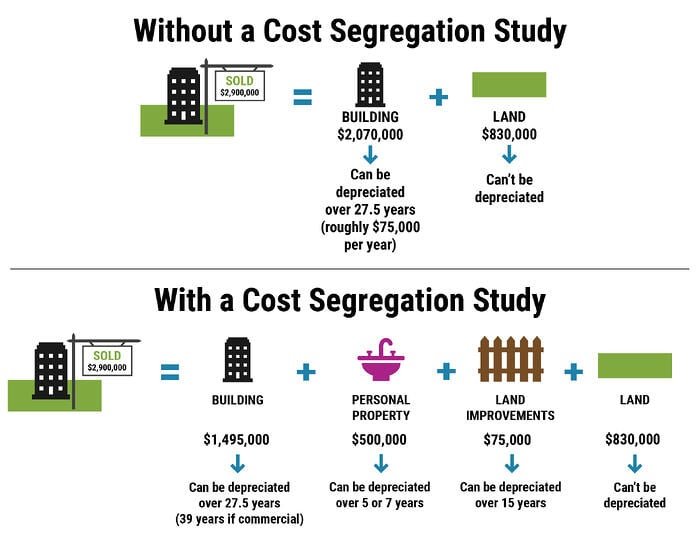

Cost segregation is the process of identifying and reclassifying components of a commercial building that can be depreciated over a shorter period, such as five, seven, or 15 years, instead of the usual long-term schedule. To make this happen, you'll want to enlist the help of a qualified cost segregation specialist, who will identify assets such as electrical, mechanical, and plumbing components that can be reclassified for faster depreciation.

But don't forget to consider the long-term implications of cost segregation. While it can provide short-term tax benefits, it may also result in a smaller tax deduction in later years. So before you start reclassifying all your building assets, consult a qualified professional to ensure the process is done correctly and meets IRS requirements.

Posted by Tim Bray on

Leave A Comment