2022 Rhode Island Residential Mill Rates by Town

Posted by Tim Bray on

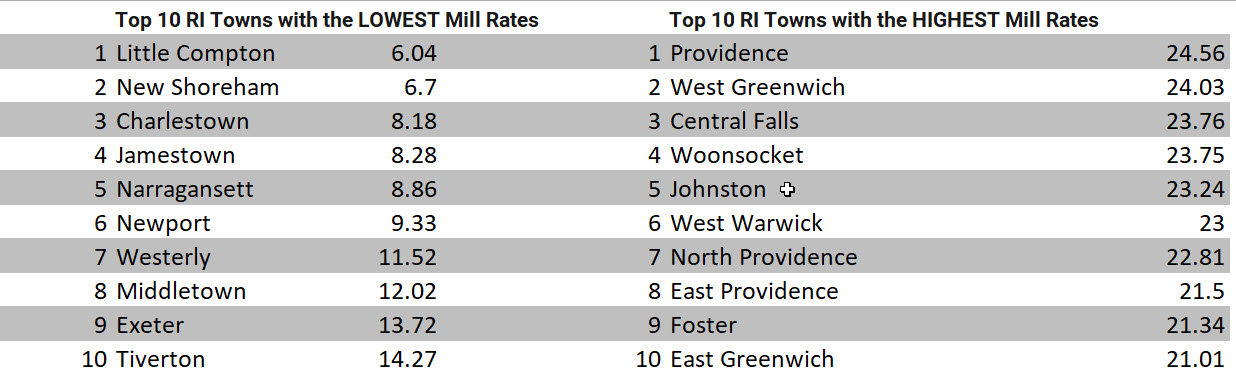

Real Estate Taxes in Rhode Island vary greatly by town and are typically correlated to the services which each town provides to its residents. A town with a lower Mill rate may not offer services such as public water and sewer, perhaps waste disposal, or a firehouse. Your real estate agent will be able to help you to determine the services offered and their importance to you when purchasing real estate. The average property tax rate in Rhode Island for 2022 is 16.93 with the highest being Providence at 24.56 and the lowest being Little Compton at 6.04.

How to Calculate Rhode Island Property Taxes

The formula to calculate Rhode Island Property Taxes is (Assessed Value x Property Tax Rate)/1000= Rhode Island Property Tax. Take the Assessed…

4147 Views, 0 Comments