What is title insurance?

Traditional insurance policies protect insureds against future losses. For example, a car insurance policy will protect the driver from future accidents, and a health insurance policy will protect an insured from future health problems. However, title insurance is different because it protects insureds against claims for past occurrences.

Who does title insurance protect?

Two different types of title insurance exist. A real estate owner can choose to purchase title insurance, and lenders can elect to do so. Lenders will require title insurance by mortgagors to secure their security interest in the property. Furthermore, a property owner will purchase title insurance to protect their investment in their property.

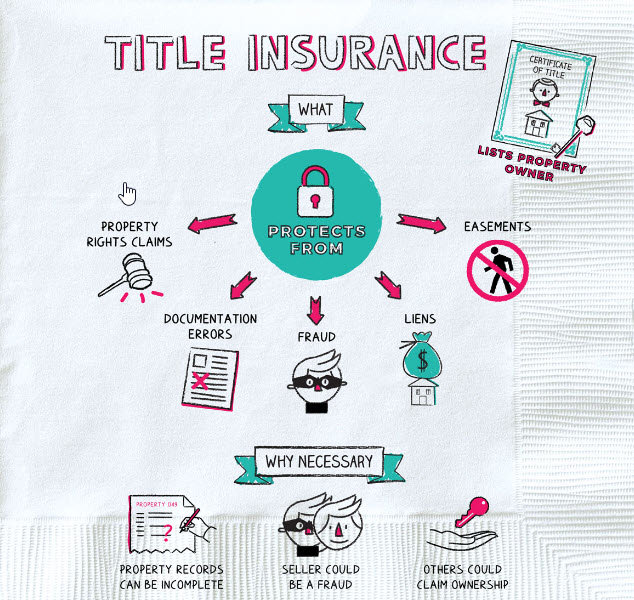

What type of protection does title insurance provide?

Title insurance will require an extensive title search of the property. This search will minimize the potential liability to the property owners by discovering any foreseeable title issues. However, once a property owner purchases and takes possession of a property, title insurance will defend against any litigation that challenges the validity and legality of the new property owner. This proved to be extremely important in Southeastern CT with tribal land disputes.

How much does title insurance cost?

Unlike traditional insurance companies, where monthly payments are required, title insurance only requires a one-time payment. This insurance will vary according to the price of your home and according to the state in that, you will purchase a home. On average, a title insurance policy for a homeowner costs $834, and for the lender, it will cost $544.

Is this expense really necessary?

The reality is that title insurance has protected a large number of insureds, but it hasn’t proportionality paid out that many claims. An estimated 4-5% of title insureds have been paid on their policy. However, these problems protected by the claims were unlikely to be detected by an ordinary purchaser. Only title insurance would protect the homeowner purchasers.

Common types of title insurance claims include:

1. Errors in the public record

2. Undiscovered Liens

3. Omitted Heirs

4. Fraud

What specific claims does title insurance cover?

These claims include certain errors in inputting information into the public record. A title examiner will assess the title by analyzing the chain of ownership of the house. They will ensure that the property is passed either by sale, through a will, or maybe even in a gift to the correct and intended person. Additionally, a title check will ensure there are no current legal claims against the house, including encumbrances such as liens, mortgages, or any existence that makes the title unable to be transferred.

The short end is that a title policy protects that small group with a problem. Title insurance is a valuable protection for home purchasers since this group has no way of detecting the problem before it arises. To be safe, it is worth spending the average cost of $834 for title insurance.

Posted by Tim Bray on

Leave A Comment