In the world of commercial real estate, the Debt Service Coverage Ratio (DSCR) is a critical metric that plays a pivotal role in the refinancing of properties. A DSCR lower than 1.2 often signals trouble, and recent trends across the country have shown an alarming 602% increase in properties grappling with this issue. However, the impact is not uniform across the board, as we'll see in the case of Connecticut, particularly in New London County.

National Context: Nationally, the picture is stark. In just the last 30 days, properties in distress have skyrocketed from 5,562 to a staggering 33,495, covering about 1.5 billion square feet of space. This surge reflects a significant shift in the commercial property landscape, indicating a broad-scale challenge in refinancing.

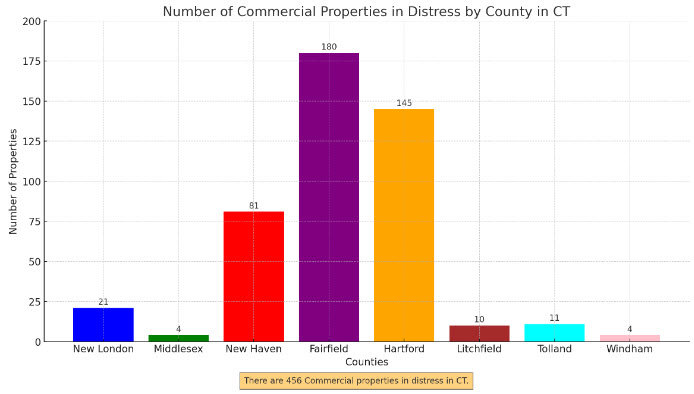

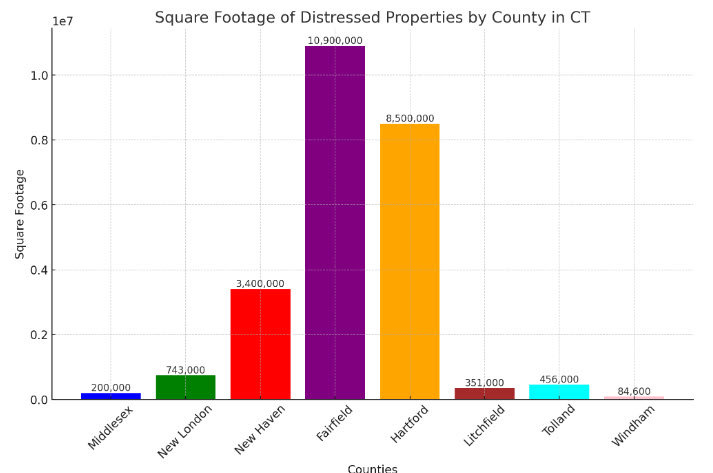

Focus on Connecticut: Zooming into Connecticut, the situation appears less dire but still noteworthy. The state has 456 properties potentially facing refinancing difficulties, amounting to 24.4 million square feet. While these figures are substantial, they're relatively minor compared to the national scenario.

Regional Variations within Connecticut: The impact within Connecticut is uneven, with significant variations across counties:

- New London County: Here, we see a relatively insulated scenario with only 21 properties in distress, representing a mere 4.6% of the state's total. This suggests a more robust local market or better financial health among property owners.

- Fairfield County: In contrast, Fairfield County is the hardest hit, with 39.47% of the state's troubled properties. This could be indicative of higher market volatility or a concentration of high-risk investments.

- Hartford County: Following closely, Hartford County sees 31.8% of the state's properties struggling with DSCR issues.

Analysis: The reasons behind these regional disparities could be manifold. Economic activities, property types, and local market conditions play significant roles. New London County's resilience might stem from a diversified economy or prudent financial management in its real estate sector, whereas Fairfield and Hartford Counties might be experiencing the brunt of market fluctuations or sector-specific downturns.

Implications :For property owners, investors, and lenders in these regions, these trends are a clarion call for vigilance and strategic planning. The data suggests a need for a nuanced approach to investment and refinancing decisions, particularly in areas with higher distress percentages. As the landscape evolves, staying informed and seeking expert advice could be crucial in navigating these challenges.

In conclusion, the real estate maxim of "location, location, location" proves its worth yet again, not just in property valuation, but also in the realm of refinancing opportunities. The varied impact of DSCR across Connecticut's counties highlights the intricate interplay between regional economic health and real estate viability.

Stay tuned to this space for more insights into the dynamic world of commercial real estate. For personalized advice or deeper analysis, don't hesitate to reach out to our team of experts.

Posted by Tim Bray on

Leave A Comment