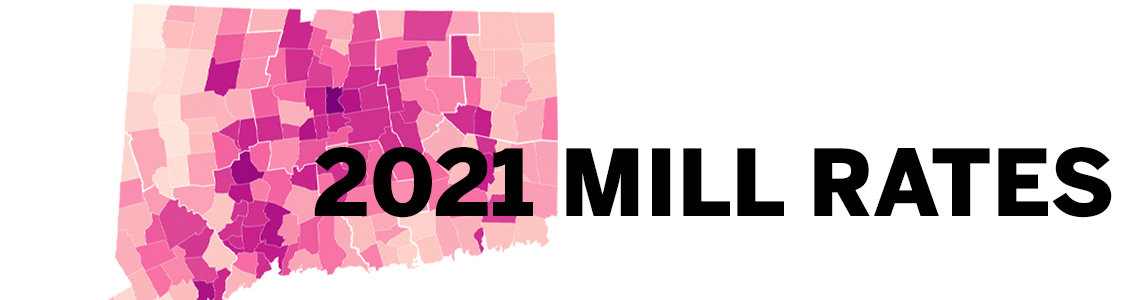

Mill Rates

Posted by Tim Bray on

Simply stated, a Mill Rate is the adjustable measure that calculates how much the tax man collects from you on an annual basis. The concept itself is easily understood.

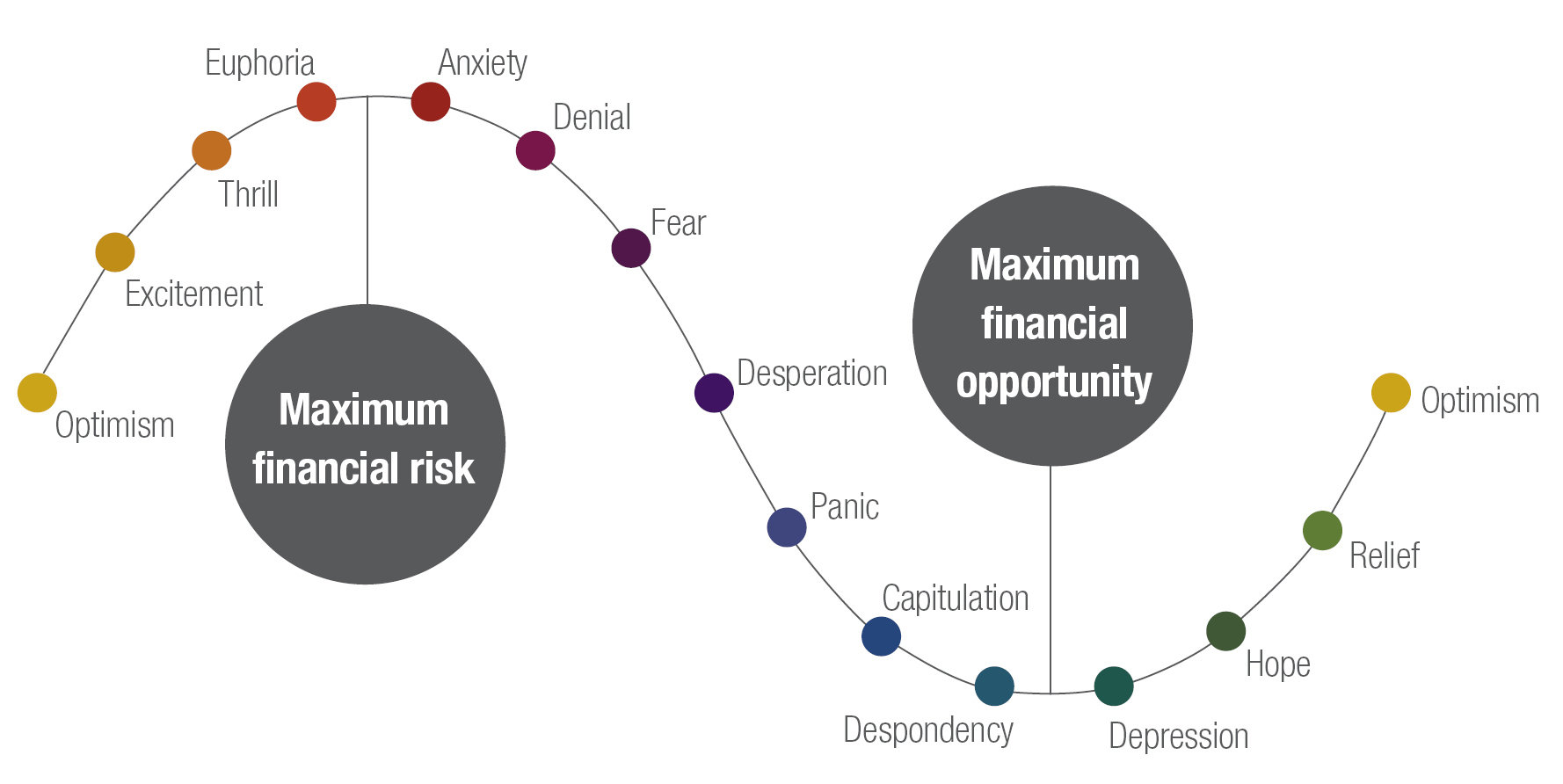

However, more insight is necessary to identify and understand the underlying, and often unforeseen market forces that can drive YOUR Mill Rate up or down, saving or costing you more money in taxes, depending upon where you choose to buy a home.

Note that each town imposes a different mill rate depending upon that town's grand list and how much revenue they must generate to cover their yearly costs.

“A mill rate is equal to $1 in taxes for every $1,000 in assessed value. To calculate your tax based on your mill rate, divide your assessed value by 1,000 and multiply the…

695 Views, 0 Comments

.jpg)