So, you wanna buy a house…. It makes perfect sense. You’re pre-approved for financing, interest rates are at all-time lows, and everybody’s doing it. You’re tired of throwing rent money out the window and ready to start building equity in your own place. It is a great feeling when you realize you can finally buy your own home. Before you pull the trigger, let's make sure you’ve covered all the bases.

Once you have set out to purchase a home, the baseline of this entire process should be centered around where you wish to buy. Not just geographically, but financially. The three words commonly referred to when discussing real estate are location, location, location. This age-old adage explains why certain areas out-perform others, attract the most buyers, and command higher prices. The elevated prices of these properties are routinely explained by their proximity to popular locations such as waterfront beach communities, local entertainment attractions as well as abundant employment opportunities, and justifiably so.

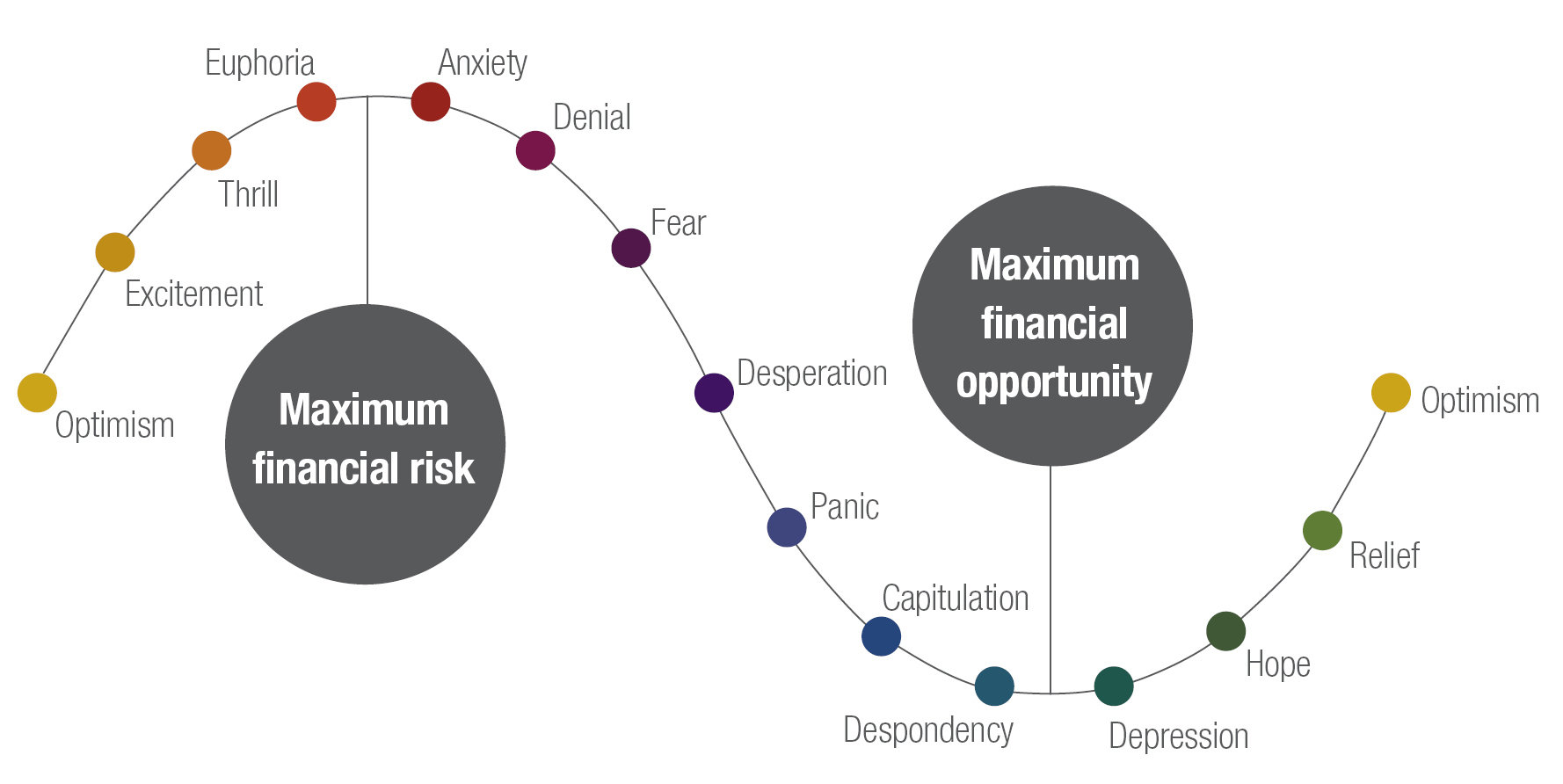

As a prospective buyer, what you are seeking is a different type of location. We want you to know where you are buying, within the Real Estate Cycle. All markets have an ebb and flow to them, and Real Estate is no different. Markets rise and markets fall. Rinse and repeat. However, no two cycles are the same. All the more reason to know where you stand. Depending upon where you purchase within this larger backdrop can make or break you financially. Much like stocks or funds in your retirement account, real estate can be under-valued or over-valued dependent upon where the market is within the cycle. This provides us guidance as to whether the current value is likely to increase or decrease.

When purchasing a home, you are in search of properties that provide the chance for significant appreciation in value moving forward. Simply stated, when you buy a house you want to know the value is going up, not down. Real value is recognized when you buy low and have the option to sell high. The easiest way to accomplish this goal is by knowing where the asking price is positioned in the bigger picture that is represented by the Real Estate Cycle. Conventional methods of Real Estate valuation provide current market values exclusively. This approach shows us where our local market is right now but does not tell us how it measures up historically and whether these values are likely to trend upward or down. As a buyer making educated decisions, you want to know that the value is trending upward, on sustainable levels. Understanding the Real Estate Cycle allows you to identify the most profitable buying opportunities, proceed accordingly and understand why.

Posted by Jon Nelson on

When COVID 19 has made a huge turn on all business industries, Real Estate is one of the industry has been greatly affected but now that things are trying to get back on their feet, there is a demand for real estate employment, which is an indication that the industry is recovering and due to this circumstances people now realize that properties are still the best lifetime investment

Posted by Real Estate Executive Search Company on Tuesday, June 29th, 2021 at 4:24pmLeave A Comment