1031 Exchange. What are they and how can they be of benefit

Posted by Tim Bray on

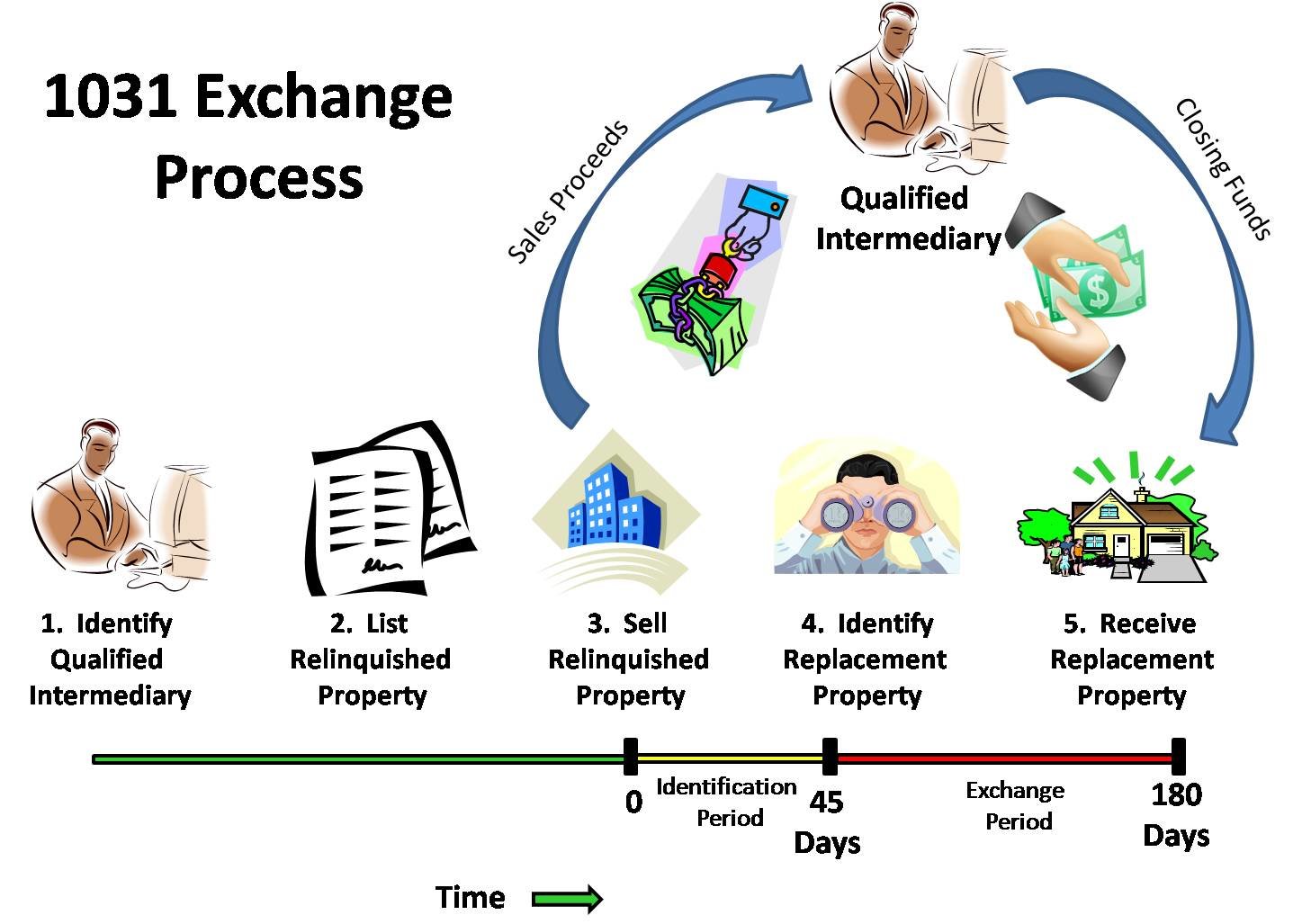

A 1031 exchange, also known as a like-kind exchange or a Starker exchange, is a tax strategy that allows investors to defer paying capital gains taxes on the sale of a property. This is done by reinvesting the proceeds from the sale into a similar property.

To qualify for a 1031 exchange, the property being sold and the property being purchased must be considered "like-kind," according to the IRS. This generally means that the properties must be used for the same purpose, such as for investment or business purposes. The properties do not need to be identical, but they must be of a similar type or nature.

There are several benefits to using a 1031 exchange. The most significant benefit is the ability to defer paying…

307 Views, 0 Comments