A 1031 exchange, also known as a like-kind exchange or a Starker exchange, is a tax strategy that allows investors to defer paying capital gains taxes on the sale of a property. This is done by reinvesting the proceeds from the sale into a similar property.

To qualify for a 1031 exchange, the property being sold and the property being purchased must be considered "like-kind," according to the IRS. This generally means that the properties must be used for the same purpose, such as for investment or business purposes. The properties do not need to be identical, but they must be of a similar type or nature.

There are several benefits to using a 1031 exchange. The most significant benefit is the ability to defer paying capital gains taxes on the sale of a property. This can save investors a significant amount of money, as capital gains taxes can be quite high. Additionally, a 1031 exchange can allow investors to upgrade to a better property, potentially increasing their income and improving their overall investment portfolio.

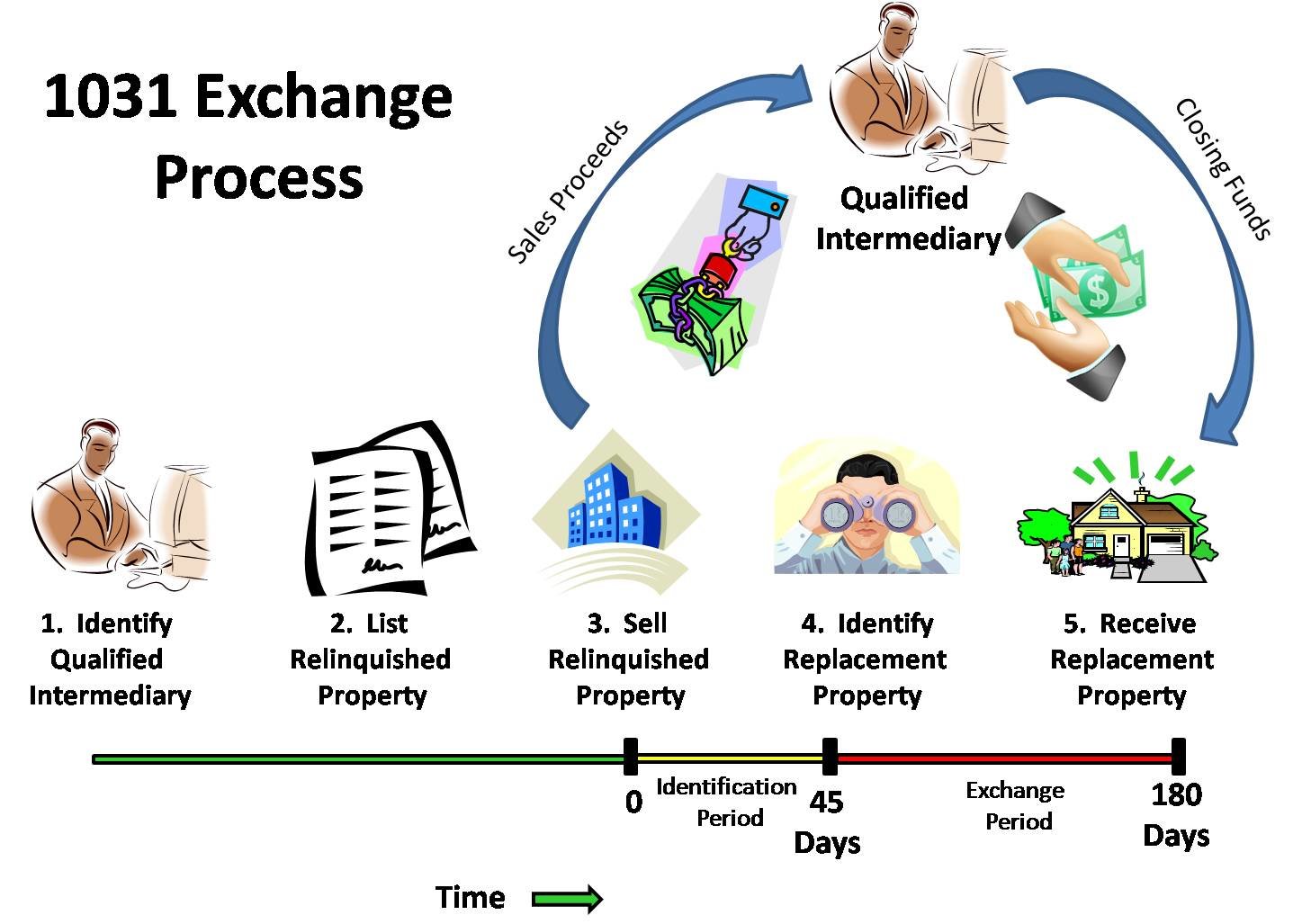

To complete a 1031 exchange, investors must work with a qualified intermediary. The intermediary is responsible for holding the exchange proceeds during the transaction and ensuring that they are used in accordance with the rules of a 1031 exchange. The intermediary can also provide guidance and advice throughout the process.

It's important to note that there are strict deadlines and guidelines that must be followed in a 1031 exchange. For example, the investor must identify the new property within 45 days of the sale of the old property, and the purchase of the new property must be completed within 180 days of the sale. Failure to follow these guidelines can result in the loss of the tax deferral and the need to pay capital gains taxes on the sale.

In conclusion, a 1031 exchange can be a valuable tax strategy for investors looking to defer capital gains taxes on the sale of a property. By working with a qualified intermediary and following the guidelines set by the IRS, investors can take advantage of this strategy and potentially save a significant amount of money.

Leave A Comment