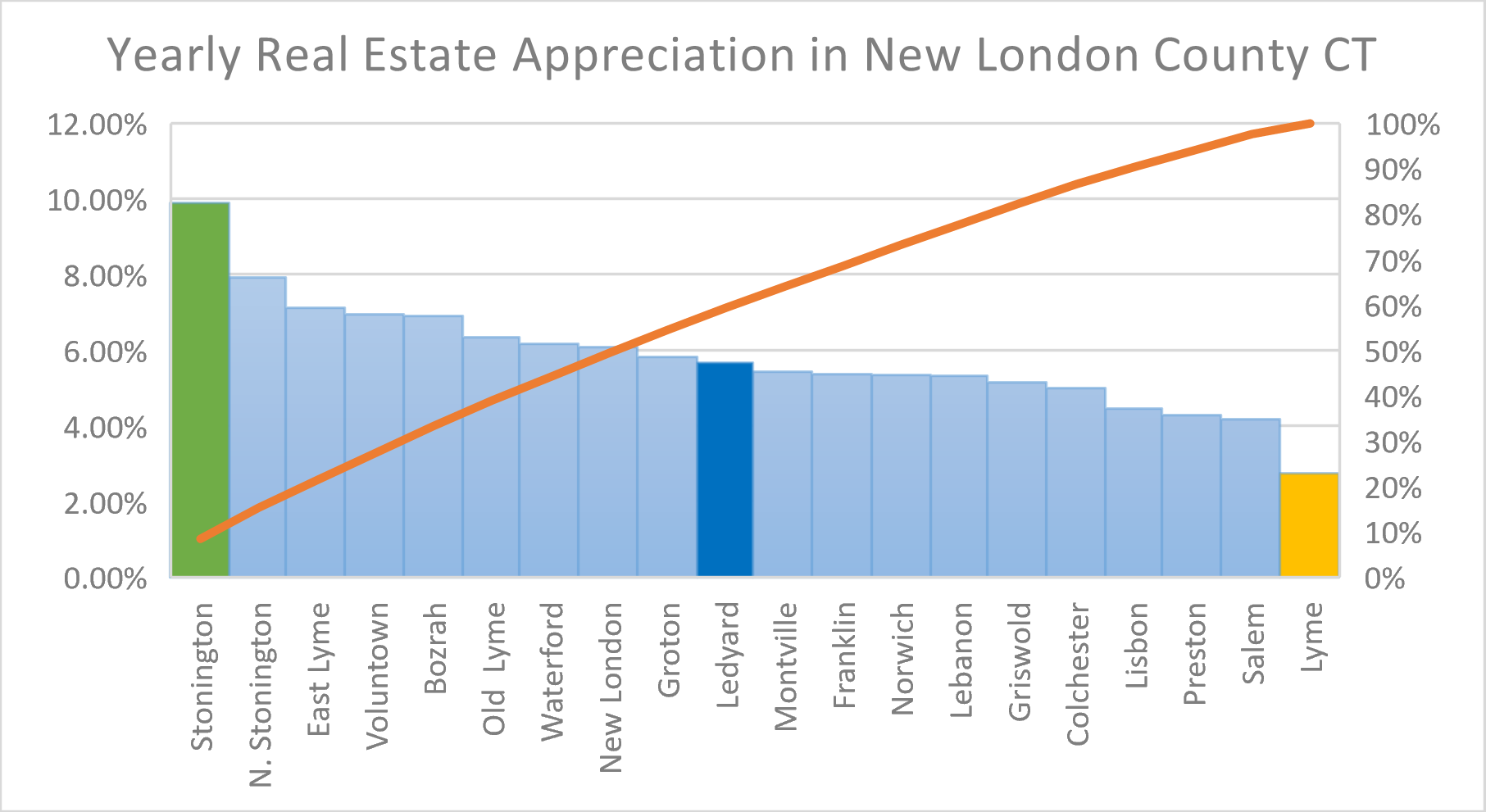

Unveiling Real Estate Appreciation Trends in New London County Over 24 Years

Posted by Tim Bray on

Investing in real estate is a significant decision, and understanding how property values have appreciated over time is crucial for both buyers and sellers. In this blog, we delve into 24 years of data from various towns in New London County, revealing average sales, typical home sizes, sales prices, and yearly appreciation rates. Join us on this insightful journey as we explore the real estate landscape of New London County.

1. Analyzing Appreciation Rates: Appreciation rates are a key indicator of a town's growth and desirability. Let's explore some noteworthy findings.

- Stonington: With a staggering 9.89% average yearly appreciation rate, Stonington has been a lucrative market for homeowners and investors alike. Its charm and natural beauty…

964 Views, 0 Comments