2023 CT Mill Rates

Posted by Tim Bray on

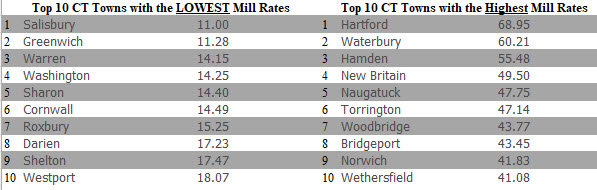

Connecticut's real estate taxes can vary greatly depending on the municipality and districts within them. The graphic above illustrates the base rates for each town. Additional rates are applied to specific locations where services are provided. These services can include public water, sewer, trash removal, police services, or a firehouse. A town or district with a lower Mill rate may not offer these services. Your real estate agent will be able to help you to determine the services offered and their importance to you when purchasing real estate. The average property tax rate in CT for 2023 is $30.50, with the highest being Hartford at $68.95 and the lowest being Salisbury at $11.

How to Calculate Connecticut Property Taxes

The…

696 Views, 0 Comments