The reality of price reduction is that when a seller lowers their price, the buyer may not know that the price has been reduced, and they likely don’t really care, because they will begin their negotiation from the new, lower price. When this happens, the seller gets no credit for reducing the price, and that is a shame. Also, after a seller or builder has done a price reduction, they are much less likely to entertain the thought of another one. So, reducing price is not always the best option if that leaves no further room for negotiations, which is understandable.

When the buyer looks for financing, they are seeking the lowest interest rate available on the mortgage, with 0 points. As you know, a buyer can pay a point or two and get a lower interest rate for the life of their loan, but this is not really an ideal situation. The upfront expense for the points does not actually give a dramatically lower interest rate, or mortgage payment. And the time to break even on the expense of the points is too long.

For example, let’s assume someone is purchasing a home and looking to get a mortgage for $500,000:

- If they chose a 30 Year Fixed Rate at 6.75% with 0 points, their monthly p/i would be $3243.00.

- Paying 1 point, which would cost $5000, might get them 6.50% or 3160.34 per month, a difference of $83.00. It would take them 5 years to make up the $5000 extra expense.

- This scenario, paying a point or more as an upfront fee, to get a lower rate for the life of the loan, is known as a Permanent Buydown.

But what if we could arrange for these folks to get a 30 Year Fixed Rate and allow them to make reduced payments for the first 2 years they are in the house? This type of financing is available…it’s called a Temporary Buydown. This is a financing arrangement where an upfront fee is paid to reduce the mortgage rate for the first 2-3 years, resulting in lower monthly payments in those years.

Temporary Buydowns were very popular in the mid-1980s to early 1990s. I did these types of loans on a regular basis because rates were much higher in those days. Since the mid-1990s these loans have not been utilized due to the ultra-low rates available, but with the rise in rates since 2022 Temporary Buydowns are once again becoming popular. In fact, most large builders in Florida, Texas and on the West Coast are offering them as an incentive to help boost sales.

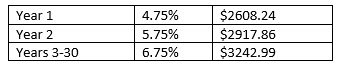

The most popular type of Temporary Buydown is a 2-1 Buydown, where a buyer closes on a fixed rate mortgage, say at 6.75%, but the rate and monthly payment is reduced to 4.75% in Year 1, and 5.75% in Year 2. This gives the borrowers much lower payment in the first 2 years. Here is the payment breakdown for our $500,000 borrower using a 2-1 Buydown:

- The monthly payment in Year 1 is $634.75 lower than the fixed rate payment. That is almost a 20% monthly payment reduction.

- In Year 2 the monthly savings is $332 or 10.2%.

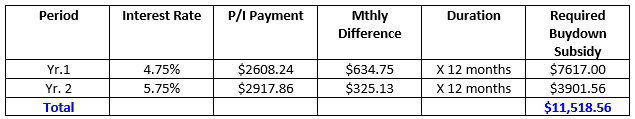

So how does that happen? How can we allow the borrower to pay 20% lower in the first year on a fixed rate loan, and 10% lower for the second year? The answer is that the difference in the monthly payments is collected upfront at closing, and the funds are deposited into an escrow account. For the first 2 years, while the borrowers are making the lower payment, the monthly difference is withdrawn from the escrow account and applied to the payment so that the borrower is paying the full, amortizing payment on their loan. Here is what the cost of a 2-1 Buydown looks like for this scenario:

$500,00 Loan Using a 2-1 Buydown

Level Payment under the note at 6.75% = $3249,99

If we divide the total subsidy cost of $11,518.56 into the loan amount of $500,000 it equals 2.30%.

For the dollar equivalent of 2.3 points the borrower can achieve a significant reduction in their mortgage payments for the first 2 years. This, in my opinion, is an excellent negotiating tool in many situations, possibly for a first-time buyer or new construction clients. Rather than reducing the price, a transaction could be structured so that the seller agrees to pay the 2.3 points to give the buyers the lower payments for the initial 2 years.

So, who might benefit from this type of a transaction:

- 1st time buyers. The buydown allows them to ease into the higher mortgage payment which may be much more than they currently pay while renting.

- Buyers with large student loan payments. The buydown allows them to pay extra on the student loans.

- Buyers who have not sold their present home but have found their dream house and want to proceed with the new purchase.

- Buyers seeking to relocate here from other less expensive metropolitan areas.

- 2nd home buyers who are not accustomed to carrying 2 mortgages.

- Buyers retiring soon who have another home to sell.

- Young buyers who are having a child soon and will be taking parental leave with less income.

- Buyers looking to resume their education or attend graduate school, who will have less income for a couple of years.

The maximum allowable seller concession per the Agencies is 6%, so on a $500,000 mortgage that is $30,000. A 2-1 buydown is not even close to the maximum 6 % concession, and that leaves room to include closing costs as well. If closing costs were $13,000 that would make the total seller concession $24,518 which is 4.9%. To learn more about Buydowns , or any mortgage related question please contact me .

Posted by Tim Bray on

Leave A Comment