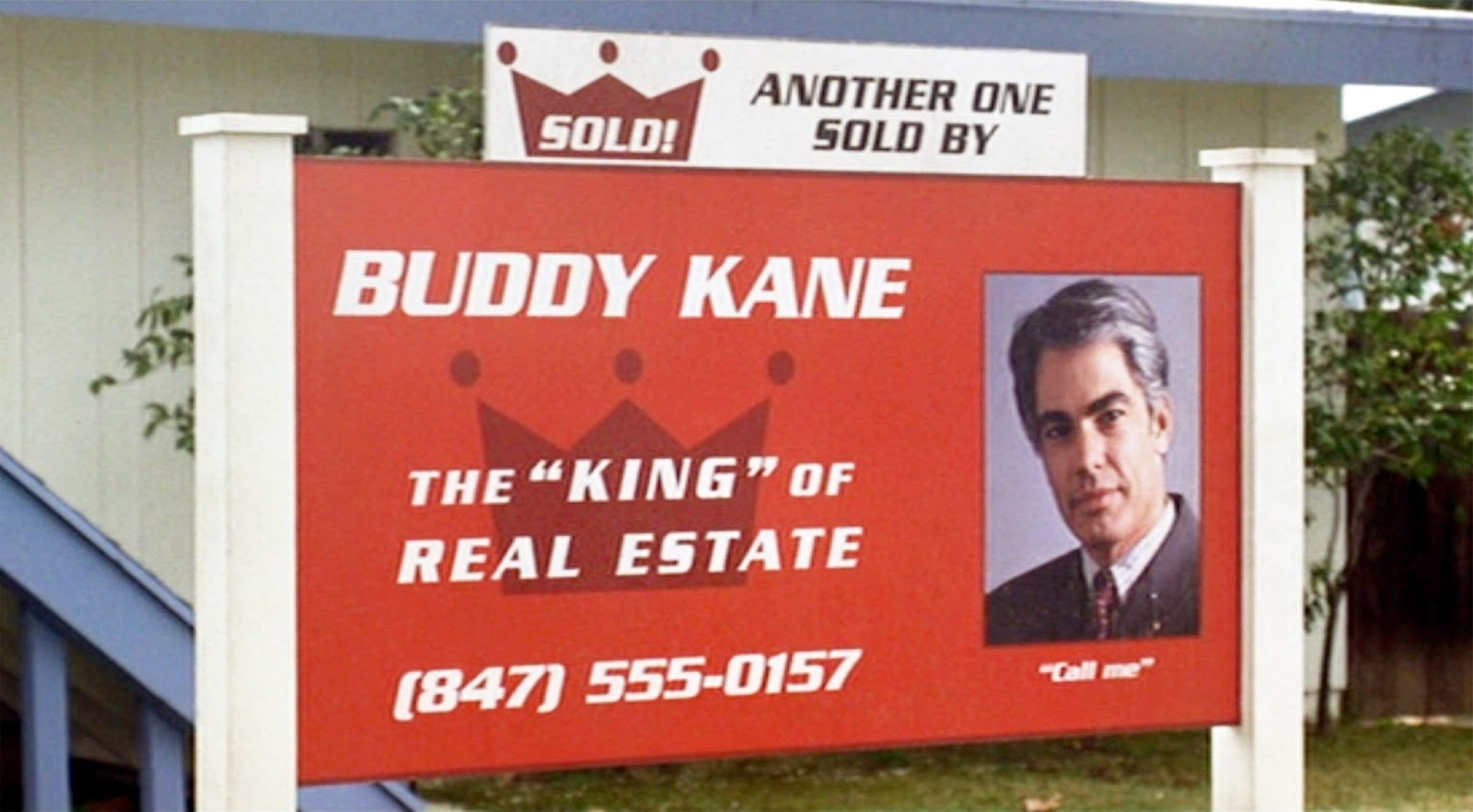

Up, Up, and Away!!!

By Buddy Kane

It’s a bird… It’s a plane… It’s another inflating real estate bubble!!! Hello sports fans. Its BK with another public service announcement on what we’re seeing on the ground. Today we’re going to talk about cash buyers, fierce competition, and a small measure of professional etiquette. Once a rare breed, cash buyers are now much more commonplace, armed with the liquid resources to prevail in current bidding wars for what little inventory remains. In the current market, if you’re not bringing cash, good luck. Within the most affordable price ranges, it used to be that first time home buyers were in direct competition for starter homes with --- well, other first time home buyers. This is no longer the case as the pool of competition has been deepened, expanded, and filled with flesh eating sharks.

To begin, it’s no secret most buyers are spending premium dollar amounts at this point, but the stakes continue to be raised with cash offers being sweetened by waived inspections, releasing of appraisal contingencies, selling of souls, etc. etc. – you get the point. All because, they can. They’re not tethered to the level of financial prudence and responsibility a lender would require of them. They’re free to continue offering as much cash as they wish, to get what they want. Not surprisingly, they usually end up paying too much of this cash, they will likely never see again in re-sale.

Too bad for them, right? Not exactly…

Not all sales are created equal. Yet somehow cash transactions are recorded right along with financed deals that are properly vetted, underwritten by lending institutions, and subject to much greater standardized scrutiny.

Nevertheless, all recorded sales, financed or cash, are thrown into the same category. They then become new comparable sales, utilized in the Sales Comparison Approach of the appraisal process moving forward. This methodology then justifies sharply increased home prices and supposed “value”, as the beginnings of a market bubble are formed. Continue inflating this bubble for extended periods like the one we’re in now, and we’ve got ourselves a party. Until it is crashed, usually in rather violent fashion. The most recent financed home buyers, having purchased at the peak of the cycle, get the brunt of it. They are often left underwater on their mortgages, without the necessary scuba to make their way back to the surface. What little gear they may have does not contain enough oxygen in the tank. Diver Down. If they are forced to sell for any reason, they will likely have to come to the closing table with cash, just to get out!

Cash buyers are not just capable of hurting themselves, but other consumers and the market as a whole. Under the current system, they bring accelerated and undue inflationary pressure with purchases not subject to lender restrictions and proven safeguards. (Changing this reality is for legislators and bureaucrats far above my pay scale. I’m more focused upon the education and awareness that can prevent our clients from participating in this brand of mess.)

If traditional cash buyers don’t sound troubling enough, lets dial it up a notch:

Once upon a time, most cash buyers were simply well-heeled individuals in search of humble living quarters. Or spoiled rotten heirs, spending Mom & Dads money foolishly. They didn’t have to bargain and squabble like the rest of us. There was very little method to their madness. If they wanted it, they got it. It was a lifestyle purchase fueled by sheer preference, well within their financial means. Their agents facilitated the purchase on their behalf while they endured another three-martini lunch.

What we’re seeing now represents a whole new realm. The playing field and number of competitors on it, is game changing. First time homebuyers in the current market are potentially competing against: other buyers, flippers, landlords, portfolios, trusts, and yes, even the very agents that used to only represent consumers. Now they compete with them.

Still not a big deal? Let’s throw another log on the fire…

Enter >>> The “Agent/Owner” or “Owner/Agent” Whichever sounds more incriminating to properly identify what they add to an already dangerous mix.

Exhibit A: Working with a local buyer recently interested in a home listed for $245,000. A rare find these days, especially in this zip code. These listings sell quickly unless they are built on an ancient burial ground. Needless to say, cash is king in presenting attractive offers in this overwhelmingly seller’s market. Not surprisingly, the seller is flooded with showings immediately and the property is under contract before we even have a chance to see it. Better luck next time.

Fast forward a week, the very same property is back on the market for sale. The previous deal must have fallen through. Upon researching it further, I discover the original sale did close. It was bid up and sold for $260,000. The new owner has it back on the market within 5 days for $290,000. No time to have made changes or improvements, the home is being marketed for sale “As-Is”, the same conditions under which it was purchased.

Here's how it shakes down:

*The property is re-listed for a cool $30,000 more than it was purchased for a week earlier

*The new owner/seller is an Agent from out of state acting on resources and advantages that consumers often gain access to after it’s too late to make moves

*It’s already under contract once again, and likely for a handsome profit due to virtually no inventory in the market

*This new sale price will be recorded, utilized moving forward and most definitely drive new appraisal values even higher. Extreme supply and demand imbalance fueling another bubble

Now, if this were your average buyer, flipper, or investor making this play, so be it. Pocket the cash, pay your capital gains and move along. But the fact that it was an agent acting on her own behalf from out of state, and bagging consumers in the crossfire leaves me struggling to keep my lunch down. On one hand, it’s a free market and the agent is free to do this as long as she identifies herself as an “Agent/Owner”. Still makes me wanna puke, given the circumstances. Perhaps I’m just naïve to the harsh ways of the world. Maybe I need to cultivate my inner Machiavelli.

But…. What’s the point of being an “Agent” acting in an “Agency” capacity as we’re led to believe, if we’re leveraging it in ways that end up screwing the very people we’re allegedly tasked with representing? Or is this, as they say, “just business”? It appears we’ve entered a culture of dog-eat-dog acceptance at all costs, placing us on trial for being a sucker if we don’t cash in, until we’re ultimately convicted of doing the right thing. Welcome to the real world. It likely won’t change, but our views of it can…

-Buddy Kane

Posted by Buddy Kane on

Great insight BK. You are brutally honest and appreciate your perspective

Posted by Tim Bray on Tuesday, March 29th, 2022 at 8:10amLeave A Comment