So, you wanna be a landlord...

Posted by Buddy Kane on

So, you wanna be a landlord….

The realities of dealing with a nightmare tenant

By Buddy Kane

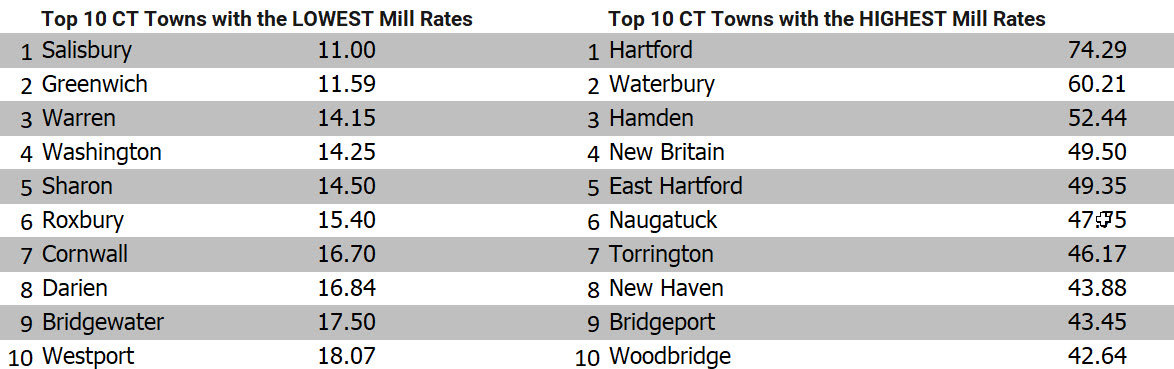

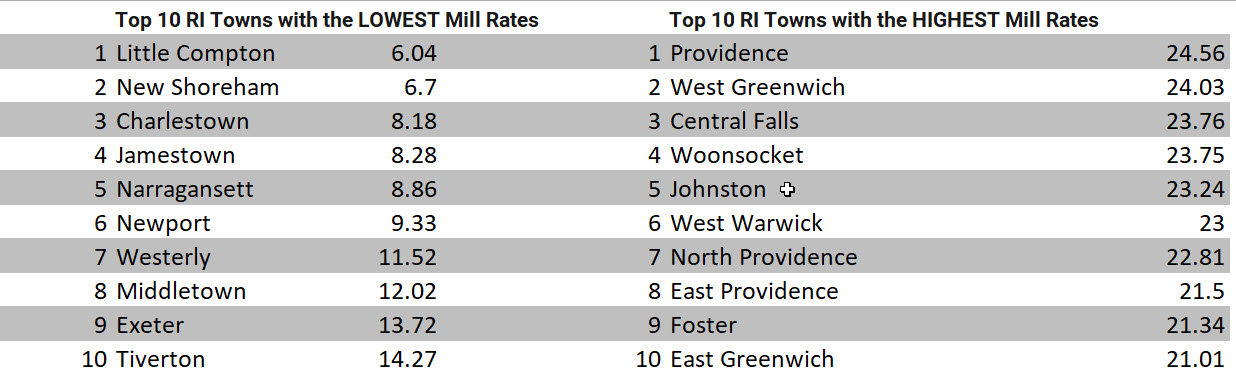

For those of you that read “Rich Dad, Poor Dad” and utilized this playbook to acquire rental properties prior to Covid, interest rate hikes, and the vanishing of real estate inventory, Bravo! You’ve done well in acquiring rental properties that now command increasing rents and low vacancy rates. It’s good to be you. Life is even better when using other people’s money to pay your mortgages down while collecting cashflow from a hard asset in an inflationary environment. Not to mention the eventual capital gain potential over the long term. This is the good news.

That being said, it’s important to be aware that every sparkling…

293 Views, 1 Comments