Are Zillow Estimates More Accurate than a Realtor?

Posted by Tim Bray on

Both Zillow and realtors can provide valuable information for buyers and sellers in the real estate market. However, the reliability and accuracy of the information provided by each may vary.

Zillow is a popular website that provides real estate information, including home value estimates (Zestimates) and property listings. Zillow's data is crowdsourced, meaning it relies on users to provide information, which can lead to inaccuracies. Zillow's Zestimate algorithm may not take into account certain factors that would affect a home's value such as the condition of the property, updates and renovation, location, and market conditions. Zillow Zestimate is considered a starting point to get a rough idea of a home's value, but it's not a substitute for…

708 Views, 0 Comments

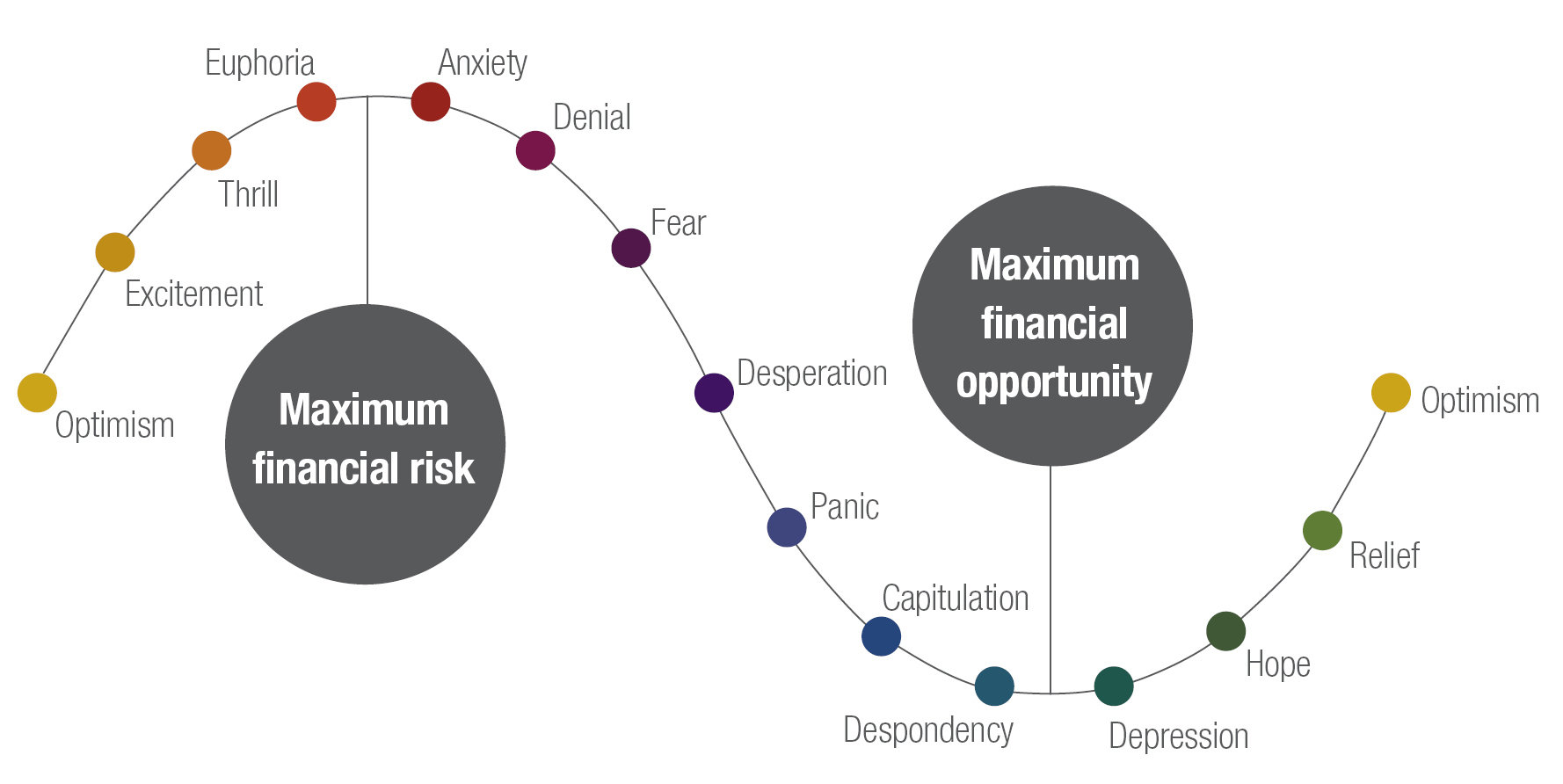

Unlike the stock market, where most people understand and accept the risk that prices may fall, most people who buy a house don't ever think that the value of their home will ever decrease.

Unlike the stock market, where most people understand and accept the risk that prices may fall, most people who buy a house don't ever think that the value of their home will ever decrease.

.jpg)